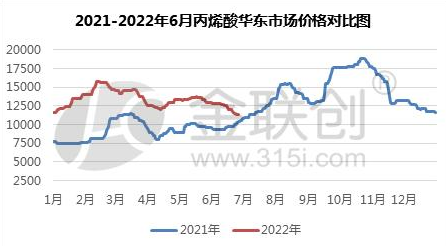

Minangka kuartal pisanan 2022, lonjakan lenga mentah internasional stimulus akrilik bahan baku propylene rega tren munggah cepet push munggah, domestikasam akrilikkutipan pasar ngiring dening tindakake-munggah saka bahan mentahan lan lingkungan kimia sakabèhé gaya munggah, prices mboko sithik menek, saka rega dhuwur nglayang. Miturut manufaktur asam akrilik sing dipimpin dening tawaran munggah push, pedagang pasar spekulasi lan aktif tindakake munggah ing promosi saka gaya kanggo nambah bagean hilir saka industri ing pangaribawa saka epidemi mung perlu kanggo tuku ing advance, separo pisanan saka wilayah domestik saka kimia mbebayani kontrol logistik kanggo nambah kangelan saka sumber salib-regional. Pasar titik ing waktu pisanan kanggo njaga tataran rega-free, tawaran perusahaan ide lan titik pasar secondary di-push kanggo tingkat dhuwur nglayang, sakabèhé narik munggah acrylic setengah pisanan saka tingkat rega rata-rata. Miturut ngawasi data Goldlink, rega sakabèhé saka asam akrilik fluctuated ndhuwur tingkat 12.000 yuan / ton ing separo pisanan 2022, karo rega paling dhuwur katon ing pertengahan Februari lan rega dhuwur-mburi cedhak 15.600 yuan / ton. Tingkat rega rata-rata pasar asam akrilik domestik ing China Wétan mundhak udakara 44% ing wektu sing padha ing taun 2021.

Sumber data: Goldlink

Analisis biaya separo pisanan

Ing babagan biaya, separo pisanan 2022 cukup nguntungake kanggo produsen asam akrilik. Utamane ing waktu pisanan, pasar asam akrilik ing lenga mentah internasional lan bahan mentah munggah macem-macem support mimpin dening bukaan saka nawarake munggah gaya, lan akrilik nawarake rega perusahaan lan pasar kanggo ningkataké operasi promosi progresif, bahan mentahan acrylic mboko sithik nyoto tiba tataran pasar asam akrilik ing epidemi domestik lan pengaruh liyane terus kanggo tingkat dhuwur saka consolidation, MediaWiki teoritis saka Enterprises produksi wungu. Miturut pitungan kasar saka asam akrilik lan bahan mentahan propylene setengah taun rega rata-rata saben unit papan MediaWiki kualitas, 2022 Januari-Juni kualitas unit asam akrilik ing ruang MediaWiki teoritis ing 5813 yuan / ton, dibandhingake karo taun sadurunge karo pitungan padha standar tingkat wutah papan MediaWiki ketok.

Pola pasokan ing separo pisanan taun

Kajaba iku, saka pola pasokan, fluktuasi kapasitas produksi asam akrilik China ing separo pisanan 2022 diwatesi, amarga statistik kapasitas piranti produsen domestik ing sawetara perusahaan kalebu parkir jangka panjang, saengga kapasitas separo pisanan 2022 diowahi dadi 3,39 yuta ton / taun. Kajaba iku, amarga pengaruh epidemi ing separo pisanan 2022 lan watesan ing logistik lan transportasi domestik liyane, persediaan asam akrilik domestik nyedhiyakake kahanan sing luwih akeh. Kajaba iku, separo pisanan saka prodhusèn domestik kacepetan sumber slowed mudhun Ngartekno, Maret-April dikarepake cilik sak mangsa puncak amarga saka impact saka epidemi domestik presented Watesan logistik, separo pisanan saka konflik panjaluk-supply presented impact luwih ketok.

Amarga impact saka epidemi domestik ing separo pisanan taun, sawetara wilayah tundhuk Watesan ketok ing logistics bahan kimia mbebayani, resumption saka perdagangan ing produk jaban rangkah uga kanggo ombone tartamtu kanggo nambah proporsi impor acrylic. Antarane wong-wong mau, kira-kira volume impor saka Januari nganti Juni yaiku 19.400 ton, munggah 71,64% dibandhingake karo periode sing padha ing 2021; volume ekspor kira-kira saka Januari nganti Juni yaiku 58.900 ton, mudhun 1,61% dibandhingake karo periode sing padha ing 2021.

Sisih dikarepake ing separo pisanan taun

Saka sisih dikarepake, industri hilir kayata construction lan industri nutupi ing dikarepake mangsa puncak tradisional mimpin dening banget, ing tingkat dikarepake pasar, asam acrylic dikarepake hilir China isih utamané klempakan ing lapangan kemul lan industri construction agen banyu-ngurangi, semen beton lan kothak liyane, industri nutupi saiki sakabèhé tingkat wiwitan kanggo njaga tingkat kurang, konsumsi asam akrilik lan bahan mentahan winates. Pengurangan banyu lan panjaluk semen konkrit liyane uga nuduhake kelemahane sing jelas ing separo pisanan taun. Kanggo industri real estate hilir terminal, kenaikan ekonomi sakabèhé kurang, panjaluk separo pisanan 2022 didorong kanthi rata.

Sakabèhé, pasar asam akrilik domestik ing separo pisanan 2022 Sejatine maintained munggah lan mudhun saka gaya operasi, sumber lan panjaluk pola saindhenging taun nuduhake kahanan stalemate.

Outlook setengah taun kapindho

Ing ngarep kanggo separo kapindho 2022, pasar asam akrilik Cina samesthine kanggo njaga gaya osilasi sawetara, karo driver utama push munggah rega isih didominasi dening produser. Kajaba iku, pasar domestik bakal terus ndeleng owah-owahan ing pola pasokan amarga pabrikan isih duwe rencana kanggo ngetrapake kapasitas anyar. Dikarepake manawa game panjaluk pasokan ing wilayah utama bakal dadi perhatian utama kanggo tren pasar.

Ing separo kapindho 2022, pasar asam akrilik Cina, pasokan lan panjaluk isih dadi faktor pengaruh utama kanggo fluktuasi rega. Tren rega asam akrilik ing separo kapindho taun 2022 dijangkepi saka 9,000-12,000 yuan saben ton. Titik dhuwur taunan bisa katon ing September-Oktober.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Wektu kirim: Jul-12-2022